Excitement About Guided Wealth Management

Table of ContentsThe 8-Second Trick For Guided Wealth ManagementGuided Wealth Management - QuestionsThe Facts About Guided Wealth Management RevealedGetting My Guided Wealth Management To WorkGetting The Guided Wealth Management To Work

The advisor will establish up a property allotment that fits both your danger tolerance and danger capability. Possession appropriation is simply a rubric to determine what portion of your complete financial portfolio will be distributed throughout different possession courses.

The ordinary base pay of a monetary expert, according to Without a doubt as of June 2024. Note this does not include an approximated $17,800 of yearly commission. Anyone can function with a financial advisor at any type of age and at any phase of life. financial advisor brisbane. You don't need to have a high total assets; you simply need to find an advisor matched to your scenario.

Guided Wealth Management Things To Know Before You Buy

If you can not pay for such aid, the Financial Planning Association may be able to assist with done for free volunteer aid. Financial experts work for the customer, not the firm that uses them. They should be receptive, willing to discuss financial concepts, and keep the customer's finest rate of interest in mind. Otherwise, you should look for a new consultant.

An advisor can suggest feasible enhancements to your strategy that may assist you accomplish your objectives better. If you do not have the time or interest to handle your financial resources, that's an additional great factor to work with a financial advisor. Those are some basic factors you could need an advisor's professional help.

Look for an advisor that focuses on informing. A good monetary advisor should not simply sell their solutions, yet provide you with the tools and resources to come to be economically smart and independent, so you can make enlightened decisions on your very own. Look for a consultant that is informed and knowledgeable. You desire an expert who remains on top of the economic scope and updates in any kind of location and that can address your financial inquiries concerning a myriad of topics.

Excitement About Guided Wealth Management

Others, such as certified monetary coordinators(CFPs), already abided by this requirement. Even under the DOL regulation, the fiduciary criterion would not have applied to non-retirement recommendations. Under the suitability requirement, economic consultants commonly service commission for the products they market to customers. This means the customer may never ever obtain a costs from the monetary advisor.

Fees will also vary by area and the advisor's experience. Some experts might supply reduced prices to assist clients that are web simply starting with monetary preparation and can not manage a high monthly rate. Commonly, a financial consultant will certainly provide a cost-free, first consultation. This consultation supplies a chance for both the customer and the consultant to see if they're an excellent suitable for each other - https://giphy.com/channel/guidedwealthm.

A fee-based advisor may gain a cost for developing a financial plan for you, while likewise gaining a commission for selling you a particular insurance policy item or investment. A fee-only financial advisor makes no commissions.

The Best Guide To Guided Wealth Management

Robo-advisors don't require you to have much money to obtain begun, and they set you back less than human financial advisors. A robo-advisor can not speak with you regarding the finest way to obtain out of financial debt or fund your child's education.

An advisor can help you figure out your savings, how to build for retirement, aid with estate planning, and others. If however you only require to discuss portfolio allocations, they can do that also (typically for a fee). Financial advisors can be paid in a number of ways. Some will certainly be commission-based and will make a portion of the products they guide you into.

The Facts About Guided Wealth Management Uncovered

Along with the often difficult emotional ups and downs of divorce, both companions will certainly have to deal with vital economic considerations. You might really well need to change your financial strategy to keep your objectives on track, Lawrence says.

An abrupt influx of cash or assets elevates instant questions regarding what to do with it. "A financial advisor can assist you believe through the methods you could place that cash to work towards your personal and financial objectives," Lawrence says. You'll wish to believe concerning just how much can go to paying down existing debt and just how much you could think about spending to seek a more secure future.

Christina Ricci Then & Now!

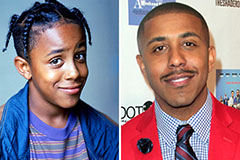

Christina Ricci Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!